How to Watch The Lord of the Rings on Netflix: A Comprehensive Guide

How to watch The Lord Of The Rings on Netflix Are you a fan of the iconic fantasy series “The Lord of the Rings”? Do you want to revisit Middle-earth …

Read Article

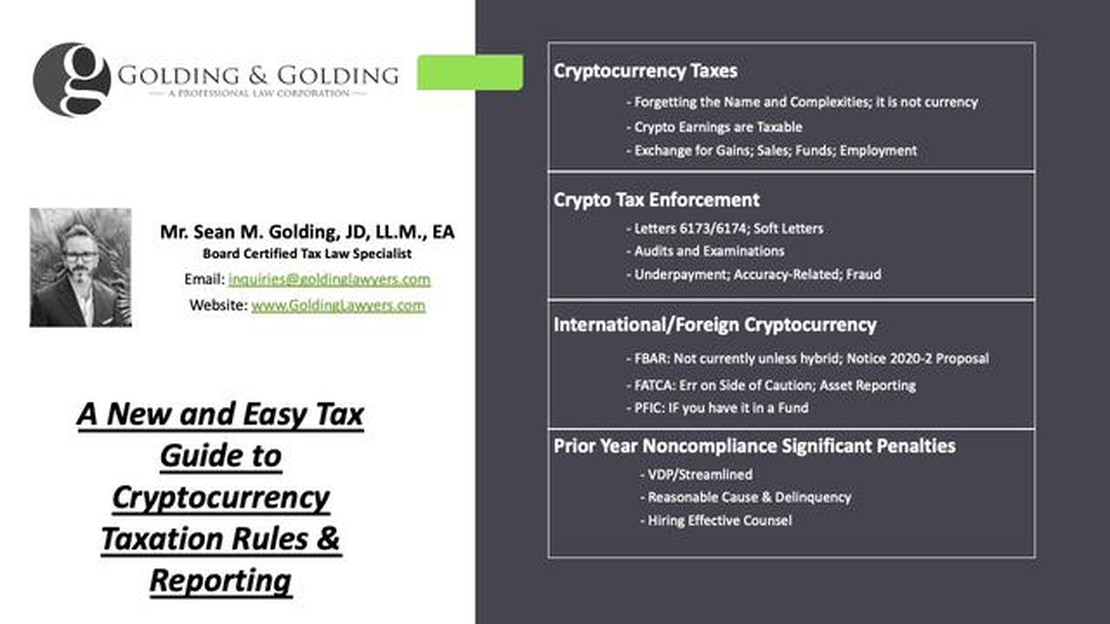

Every year cryptocurrencies are becoming more and more popular as a means of investment, trading and storing funds. Along with this, the interest of tax authorities in this type of assets is also growing. Thus, it is important for cryptocurrency owners to be aware of the rules and procedures related to the calculation and payment of taxes in 2023.

First, it is important to realize that cryptocurrency is considered property, and transactions involving it can be considered a capital investment. This means that when you sell cryptocurrency, you may be subject to tax on the gain from its sale. However, if you have held the cryptocurrency for less than one year, the gain may be taxable as trading income rather than a capital investment.

It is important to note that the timing and taxation rules for cryptocurrency may differ from country to country. Therefore, it is recommended to consult a professional tax advisor or familiarize yourself with the relevant laws and regulations of your country.

To calculate cryptocurrency taxes in 2023, it is important to take into account both income from the sale of cryptocurrency and expenses related to its acquisition and storage. These can include exchange commissions, payments to miners, expenses for mining equipment and software, and other costs associated with cryptocurrency.

When doing taxes on cryptocurrency in 2023, remember to comply with all requirements of the tax authorities, including filing returns on time, reporting profits and paying the tax. This will help you avoid consequences in the form of penalties, audits or other negative measures applied by tax authorities.

Cryptocurrency taxes are calculated in accordance with the current tax rules and laws. The main principles of calculating taxes on cryptocurrency include the following:

To calculate cryptocurrency taxes more accurately, it is sometimes necessary to account for all cryptocurrency transactions during the tax period, not just the transactions that generated income.

In addition, it is worth noting that many countries have imposed tax obligations on cryptocurrency transactions, such as providing transaction information, billing statements and reporting. Therefore, it is important to be careful and conscientious when calculating and paying taxes on cryptocurrency.

| Income from cryptocurrency transactions | Expenses related to cryptocurrency transactions |

|---|---|

| * Revenue from the sale of cryptocurrency for money; |

The exact rules and methods for calculating cryptocurrency taxes may differ depending on the country where cryptocurrency transactions take place. Therefore, it is recommended to carefully study the tax laws and consult with experts to calculate cryptocurrency taxes correctly and accurately.

Calculating taxes on cryptocurrency is a complex process that requires various aspects to be taken into account. Here are some of the key factors to consider when calculating taxes on cryptocurrency:

It is important to note that the rules and laws governing the taxation of cryptocurrency may vary from jurisdiction to jurisdiction. Therefore, it is recommended that you consult with a lawyer or tax professional to accurately understand the current rules and requirements in your country.

The need to account for and properly calculate cryptocurrency taxes is important to comply with laws and avoid legal problems. Knowing and understanding the basic accounting aspects of tax calculation will help you stay on top of the requirements and do the calculations correctly.

In 2023, there are a number of changes expected in the taxation of cryptocurrencies that are important to take into account when calculating your tax liability. Failure to comply with these changes could result in serious legal consequences and penalties.

1. Clarification of definitions:

The authorities are seeking to clarify definitions related to cryptocurrencies in order to establish clearer taxation rules. The definition of cryptocurrency, token and other key terms are expected to be clarified.

2. Mandatory declaration:

In 2023, mandatory declaration of cryptocurrency transactions is expected to be introduced. This means that citizens and companies will be required to submit detailed reports on their cryptocurrency transactions to the tax authorities.

3. Taxation on cryptocurrency exchange:

There are various ways to exchange one cryptocurrency for another. However, taxation on such transactions is expected to be introduced in 2023. This means that citizens and companies will have to pay taxes on the profits made from the exchange of cryptocurrency.

4. New tax rates:

Read Also: Beginner's Guide: How To Play Call Of Duty Mobile On New in 2023

Due to the clarification of definitions and the introduction of new tax rules, it is expected that new tax rates on cryptocurrency transactions will be introduced. This may affect the overall tax burden of citizens and cryptocurrency companies.

5. Reduction in benefits and exemptions:

In 2023, the benefits and exemptions for cryptocurrency transactions are expected to be reduced. Previously, there were some tax exemptions for cryptocurrency transactions, but the new changes may reduce or eliminate these exemptions altogether.

To avoid problems with tax authorities and to keep your cryptocurrency transactions legal, it is recommended to contact tax experts. Only they will be able to provide professional advice and help to correctly calculate tax liabilities in 2023.

Read Also: Call of Duty Warzone Lite: performance improvements on Xbox One and PS4

In 2023, there are several important changes in the legislation on the taxation of cryptocurrencies, which should be taken into account when calculating tax liabilities.

All these changes in the law should definitely be taken into account when calculating taxes on cryptocurrency assets in 2023. It is recommended to contact a specialist or accountant for detailed information and advice on this matter.

Working with cryptocurrency requires special attention to tax obligations. When receiving income or conducting transactions with cryptocurrency, it is necessary to correctly fill out a tax return in order not to violate the legislation.

First of all, it is important to realize that when dealing with cryptocurrency, personal income tax or capital gains tax usually applies. Each country may have its own specifics of cryptocurrency taxation, so it is important to familiarize yourself with the applicable laws and requirements.

You should include the following information on your tax return when dealing with cryptocurrency:

In addition, it should be noted that in some cases, special tax exemptions or rules for cryptocurrency transactions may apply. For example, in some countries, tax exemption is possible when exchanging one cryptocurrency for another.

It is important to remember that filling out a tax return when working with cryptocurrency requires care and accuracy. It is better to consult a professional tax consultant or use special software to automate the process of preparing the declaration. This will help to avoid mistakes and paying an insufficient amount of taxes or, on the contrary, an excessive amount.

Tax laws regarding cryptocurrency are subject to change, so it is important to follow updates and be aware of the latest changes in the tax regulation of cryptocurrency.

There are several types of taxes to consider when working with cryptocurrency. The main ones include: tax on profits from cryptocurrency transactions, capital investment tax, and value added tax. In addition, depending on the country, declarations on the presence and use of cryptocurrency may be mandatory, as well as taxes on inheritance or gift of cryptocurrency.

The choice of tax regime when working with cryptocurrency depends on the form of ownership of cryptocurrency and the intentions of the individual entrepreneur or legal entity. For example, you can be an individual entrepreneur and pay income tax, or register as a legal entity and choose the optimal taxation system, taking into account all possible deductions and benefits.

The amount of income when selling cryptocurrency is determined by deducting the value of the acquired assets from the sale price. Exchange commissions and other related expenses are also taken into account. If the cryptocurrency was received as payment, the amount of income is determined based on the market value at the time the cryptocurrency was received.

The following deductions can be taken into account when calculating taxes on cryptocurrency: working tax deductions (for children, education, home repairs, etc.), property deductions (for the payment for an apartment, car, etc.), deductions for financing scientific and investment projects, as well as deductions for donations to charitable organizations.

How to watch The Lord Of The Rings on Netflix Are you a fan of the iconic fantasy series “The Lord of the Rings”? Do you want to revisit Middle-earth …

Read ArticleGet ready for the third season of apex legends as respawn adds a new hero, map and more The expectations of Apex Legends fans have finally been turned …

Read ArticleHow to get a free edu email address (100% works) Using an email address with the .edu extension can have a number of benefits, especially for students …

Read ArticleGalaxy S9 Plus email setup error: “The username or password is incorrect or POP3/IMAP access isn’t turned on for this account.” Setting up email on …

Read ArticleGalaxy Note 20 Turned Off, Won’t Turn On Is your Galaxy Note 20 not turning on? Don’t panic, as this is a common issue that can be fixed in most …

Read ArticleReview: Samsung Galaxy S23 Ultra offers an incredible screen and long-lasting battery life The Samsung Galaxy S23 Ultra has been making waves in the …

Read Article